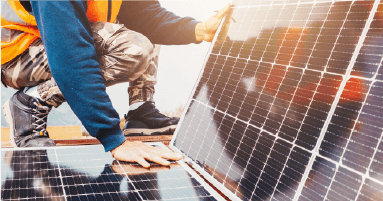

When it comes to paying for solar panels, there are generally two ways for homeowners to consider: cash upfront or a longer-term financing option. Unfortunately, paying in cash upfront is not a realistic option for most people and instead, many homeowners take out finance to spread the cost of their solar panels over time.

Financing a solar system is a great option because you get all the same perks of system ownership like lower energy bills and reduced reliance on your energy company (and the price they set) but with a minimal down payment — or none at all. Most homeowners repay their loans within five to 10 years using the energy savings provided by their solar panels.

Here are a few of the biggest advantages of financing a system:

- Pay for your system using money you’ve saved from reduced energy bills

- Less reliance on energy prices

- Boosts your property value

What if you don’t have the money on hand? Can you still enjoy huge savings and high returns? Yes.

Solar loans are an increasingly popular option throughout the UK. However, how does this financing approach work? More importantly, does it really make sense to go into debt?

How Do Solar Loans Work?

A solar loan is similar to a cash purchase in that it enables you to finance a new PV installation outright and pay for it with short-term loan, rather than using liquid income as a form of payment.

Just as with any loan, you’ll make monthly repayments until the loan is completely repaid. However, your solar installation begins reducing your utility bill the moment your PV panels become operational.

In the UK, a typical solar system can save a household £80 a month in electricity costs, and since it is owned by you, you also have the ability to sell the excess power back to the grid.

Instead of paying down your debt out-of-pocket, you can use your monthly savings and earnings to repay your loan. Once the loan is repaid, the system is 100% yours. Moreover, you continue collecting savings and earnings for years to come.

The Advantages of Using Solar Loans in the UK

It is clear from the above example that borrowing money can actually pay off in the long run. A PV system that might otherwise be unaffordable is now within easy reach. And as the installation owner, you receive all of the same financial benefits as if you had used your own money. Solar incentives, earnings, and savings all come directly to you.

Are Solar Loans the Best Option for You? If you want the financial benefits of owning a PV installation but don’t have the disposable income, taking out a solar loan is a great option.

However, it’s not the only option out there. If you’re looking to get solar panels installed on your property, speak to our team of experts today, who are only a phone call away from providing you with a system that is right for you at an affordable price.

If you’ve already decided how to finance your system, request a free solar quote today by clicking here.